BMO GAM ahead on policy, Scotia GAM lags, all have work to do

With a lot of media attention in past weeks focused on Canadian banks stepping away from the Banking Net Zero Alliance, many are concerned that they may be less serious about their net zero commitments than they seemed. The findings of our most recent annual report on the progress of Canadian banks on their net zero commitments helps shed some important nuance on the issue.

This year, our annual Canadian banks net zero report shifted focus to the banks’ massive and carbon-intensive asset management arms. Usually, the focus is on the banks’ capital market divisions, but with no substantive progress in that regard this past year, we felt it was time to shift our attention to the bank’s large and carbon-intensive asset management businesses.

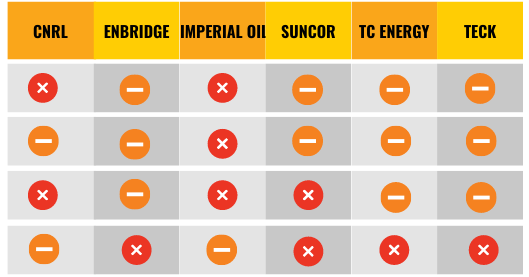

The report, released late January, uses internationally-accepted standards to rate the banks’ asset managers on criteria ranging from setting a clear net zero target, to engagement strategies, to climate solutions investing – BMO GAM being the major standout. Overall, when it comes to investing their clients’ money, banks are progressing more slowly on net zero than when lending their money to businesses. Our summary table provides a visual representation of their wide range of progress.

Canadians should be concerned that their banks are taking a more lax approach to net zero with their savings than they are with the rest of bank operations. As climate risk builds in the financial system, with events such as the Los Angeles fires previewing the shocks to the economy, asset managers need to do a better job of ensuring a secure future for their clients’ money.

Which asset manager explicitly commit to net zero?

Despite all assessed companies having parent companies with net zero commitments, only two of the 6 banks have asset management arms with clear net zero commitment: BMO GAM and National Bank Investments. Scotia GAM’s subsidiary Jarislowsky Fraser, also stands out for its clear commitment to net zero. Net zero commitment or not, all are heavily invested in fossil fuels (see table below). While RBC GAM has the largest overall amount of fossil fuel investments at around $65 billion, BMO GAM has the largest percentage of its AUM invested in fossil fuels at 10.6%.

How are they de-risking their AUM?

Nonetheless, all set net zero financed emissions target, which is an acknowledgement of the material financial risk presented from carbon-intensive investment. So, what kinds of actions are they committing to take to derisk their AUM? Only National Bank Investments has begun to exclude coal from a portion of its AUM – that which it invests on its own behalf. BMO GAM has also started to lobby governments to put in place policies that help enable the energy transition, including tighter emissions regulation of oil and gas companies. Finally, we see most escalating their engagement with carbon-intensive portfolio companies via shareholder resolution votes. Notably, RBC GAM and BMOG GAM each also have at least one instance in 2024 of withholding responsible director election votes for climate-related reasons.

How are they enabling their clients to benefit from the energy transition?

In terms of maximizing their climate-related opportunities, only BMO GAM and CIBC GAM offer investment products that support the energy transition. NBI may also join this list when more information is made available regarding their new Global Climate Ambition Fund (more details available in the report’s Appendix). Other retail investment products are branded as “sustainable” or ESG-related, but contain holdings in fossil fuel companies expanding production, thereby making climate change worse. Regulators in other jurisdictions have begun to push back on this type of marketing.

How do they compare globally?

Canadian bank asset managers lag their global peers, such as BNP Paribas Asset Management, HSBC Global Asset Management, Nomura Asset Management, and Swedbank Robur, which have more robust net zero frameworks.