Assessing Great-West Life, Manulife, & Sun Life

In our third annual Canadian life and health insurance net zero progress report we added Canada’s 2nd largest life and health insurer, which is also one of the country’s top 10 fossil fuel investors: Great-West Lifeco (parent to Canada Life, subsidiary of Power Corp).

What’s new this year?

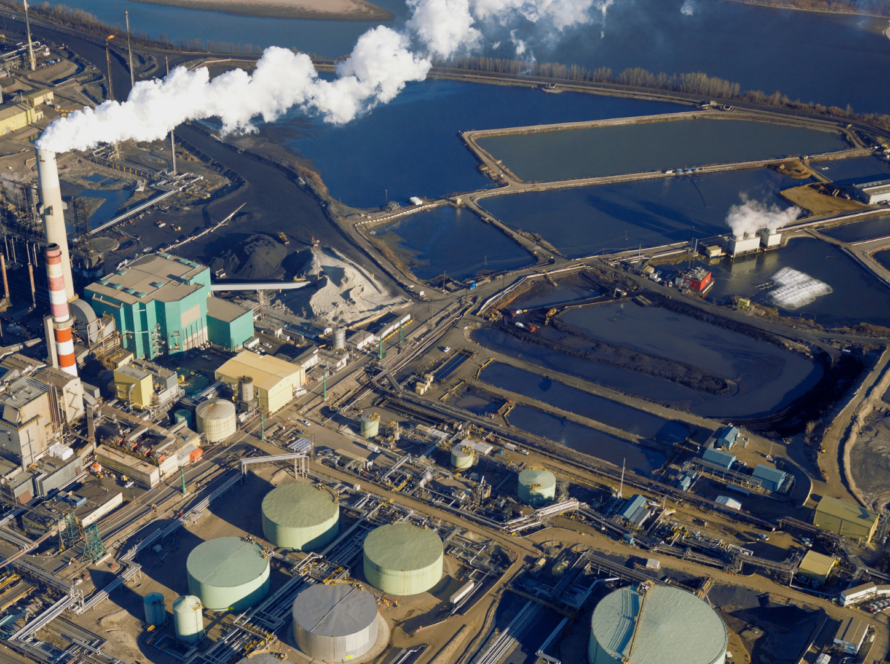

The link between climate change and health is becoming clearer. And yet, these three insurers have over $90 billion combined in fossil fuel investments, nearly a quarter of their $3.7 trillion in total AUM. The contradiction this presents with their mandate to protect their clients’ wellbeing is increasingly apparent.

Climate action at the three insurers remains sparse, despite their 3-year-old voluntary net zero commitments. Especially lagging is our newest addition, Great-West, which only reports 1% of its general account financed emissions.

There are a few glimmers of hope. For example, we see two (relatively small) asset management subsidiaries, one each at Sun Life and Great-West, that have set relatively strong fossil fuel exclusions.

More pressure for net zero progress is coming. Starting next year, these insurers, including their expansive third party asset management businesses, will be expected under OSFI’s B-15 to start disclosing their climate risks and opportunities.

Detailed company assessments are provided in a separate Appendix.