Shareholder resolution withdrawal agreement helps entrench climate expertise and oversight at board level

March 5, 2025

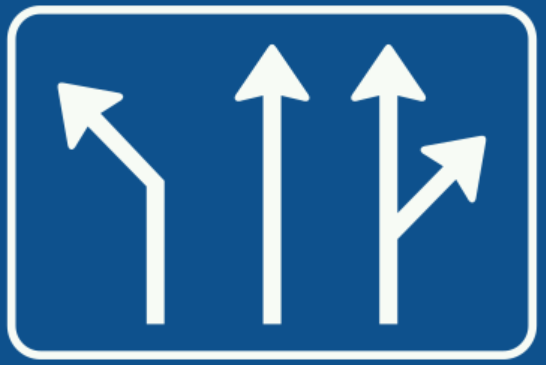

For the third consecutive year, we submitted a shareholder proposal at TD Bank, this time escalating our call for improved climate risk management and follow-through on their net zero commitment by urging a reset at the board of directors. The resolution echoes increasing institutional investor expectations for more sophisticated climate governance at carbon-intensive companies, like Canadian banks. The thinking being that major business transitions require a new set of skills and responsibilities at the highest level of corporate decision-making.

Engagements regarding our governance proposal led to a withdrawal agreement outlined in the bank’s Proxy Circular, released yesterday. The agreement – outlined on p.102 – could signal a positive shift for the bank towards a net zero governance refresh.

A broader commitment to governance renewal was signalled earlier this year when TD announced the early replacement of four directors from its board, including the CEO. This governance refresh is helping improve investor confidence, which has been waning since the money laundering scandal came to light last year and, more recently, the bank withdrawal from the Net Zero Banking Alliance.

This agreement sets the stage for TD to better align with best practices in climate governance, as called for by major institutional investor groups like Climate Engagement Canada. TD’s commitment in response to our proposal could put the bank on a path toward more effective board oversight of climate transition risks, which we hope will help reverse its lagging net-zero progress.

The details of the proposal

This year’s resolution, filed alongside Vancity Investment Management and Green Century Capital Management focused on board-level accountability. It requested

“an independent review of TD’s board governance policies and director selection criteria with a view to improving accountability and competency regarding key risks and emerging priorities.”

The supporting statement clarifies how ‘net zero’ fits squarely within the definition of “key risks and emerging priorities.” The main justifications for the requested review are the ongoing governance failures exhibited by both TD’s money laundering fiasco as well as its ongoing failure to progress on its net zero commitment.

The withdrawal agreement

TD’s Annual Proxy includes a commitment (at 102) in response to our resolution to prioritizing climate expertise at the board level, including updates to its Board Skills Matrix and more detailed biographical information of director nominees. It further commits that its ongoing governance review—prompted by money laundering charges— “is robust and being conducted in the context of the bank’s business activities and corporate governance practices generally.” We were assured this extends to the bank’s ongoing net zero commitment and other emerging priorities.

The agreement signals a better prioritization of climate at the board level. These steps are designed to ensure that board members possess the necessary expertise to navigate the complexities of climate transition risks and lead the bank in meeting its net-zero commitments. As a result, TD could be better equipped to embed climate-related decision-making at the highest levels of governance.

While the agreement marks an important step, TD, like many other financial institutions, will face significant challenges in translating these commitments into tangible actions. None of the five new board nominees listed in the circular appear to have specific climate expertise. Continued pressure from investors and stakeholders will be necessary to ensure that progress is sustained.

The significance of board-level climate expertise & oversight

TD’s commitments to incremental climate governance improvements are potentially significant. It shows the bank is possibly responding to the growing expectation among institutional investors for carbon-intensive companies to embed climate expertise at the board level. For example, board level climate expertise was a major gap identified by Climate Engagement Canada’s 2024 benchmark assessments of 41 carbon-intensive companies. An analysis paralleling the work undertaken by Climate Action 100+. A similar gap was also identified by the Transition Pathway Institute’s analysis of 38 global banks net zero progress, where it found that none of the banks it assessed in 2024 satisfied two climate governance criteria that assess whether the bank:

- assessed these individuals’ competencies with respect to managing climate risks and disclosed the results of those assessments, or

- disclosed details on the criteria used to assess the board competencies with respect to managing climate risks and/or the measures taken to enhance these competences.

With more effective board oversight of climate transition risks, TD has the potential to reverse course on its lagging net zero progress.

What to expect going forward

Our ongoing engagement with TD Bank over the past few years has laid the foundation for this agreement, which represents a crucial step in TD Bank’s evolving climate governance framework, but the work is far from complete. What remains is for TD to apply its updated Board Skills Matrix to refresh its Board with new members who have climate expertise, whether that be experience in climate finance, renewable energy, or other related fields. We note an improvement of climate expertise on the board:

- new board nominee Nathalie Palladitcheff has sustainability experience related to the real estate market,

- new board nominee Ana Arsov has experience related to bank ESG risk analysis, and

- board member Cherie L. Brant has promoted Aboriginal participation models for renewable energy procurement.

With the stepping down of director Claude Mongeau, cross-appointed at Cenovus, we look forward to TD replacing more of their directors with cross-postings at oil and gas companies, which may well represent a systemic conflict of interest with its net zero commitment.

As TD and other financial institutions navigate the complex transition to net-zero, continued shareholder engagement and transparent, actionable commitments will be essential in driving real change.

We remain committed to working alongside institutional investors and stakeholders to ensure that banks continue to prioritize climate risk at the highest levels of governance, pushing for accountability and meaningful action on their net-zero commitments. Our engagement with TD Bank will serve as a foundation for further progress, and we are eager to continue advocating for a future where financial institutions are leaders in the global effort to address climate change.