By Kiera Taylor

The recent wildfire in Jasper is a devastating reminder of the increasing frequency and intensity of wildfires across Canada. With estimates suggesting that up to half of the structures in Jasper have been destroyed, our thoughts go out to the residents and the first responders on the ground. If you have the resources, consider donating to the Canadian Red Cross to assist those impacted in Jasper and other affected areas in Alberta. But, we must also examine the drivers of these disasters, including the fossil fuel industry and those who enable it.

The Insurance Bureau of Canada (IBC) refers to insurers as “second responders” in the aftermath of catastrophes. It’s true that insurance companies play a crucial role during rebuilding and recovery efforts. “Your insurance company is here to help you. This is what they plan for. This is what they’re here for,” said an IBC representative.

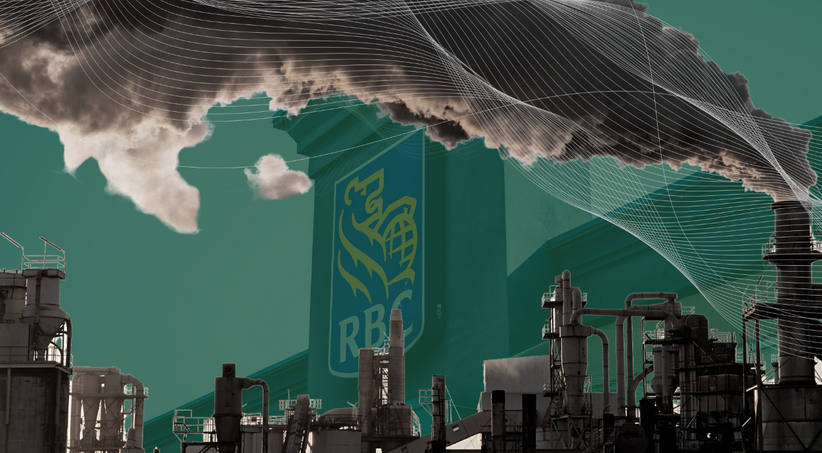

While it’s important for us to hear from risk managers in times of crisis, unfortunately, this role as a second responder is accompanied by the role of causal agent. That is, insurers are propping up the fossil fuel industry and are therefore helping to cause the very climate-related disasters they must respond to.

Canada’s property and casualty insurers, and in particular Fairfax, enable the fossil fuel industry via underwriting. They are also major investors. In 2023 alone, Canada’s seven largest property and casualty insurers and their parent companies invested more than $19.5 billion in fossil fuel assets. By underwriting and investing in fossil fuels, these companies are helping to finance the climate catastrophes they are supposed to mitigate. This contradiction is examined in our report, Playing with Fire: Canadian Insurers and Fossil Fuels.

Fossil fuels drive climate change, which has caused Alberta to become a hotbed of wildfires with at least 50 currently burning out of control and other towns experiencing destruction to homes and businesses. Many of Canada’s costliest insured catastrophes have been fire-related; the Okanagan and Shuswap wildfires caused $720 million in damage alone.

The impact on customers is clear. Beyond exposure to fire and flood risk itself, insurance premiums rise for all, and coverage is pulled back for some. Following a catastrophic event, insurers have the ability to readjust premiums and coverage. The impacts of this are already seen across Canada, as fire insurance rates more than doubled in one year in Kamloops BC, and some Halifax residents had to crowdfund after their homes were destroyed from fires.

While standard home and business insurance is said to cover damage from wildfires, depending on specific replacement cost coverage, coverage for many in Jasper may be not as clear. Many Jasper residents are also temporary workers and employer tenants, which means large losses for those who are uninsured. According to the head of the Intact Centre on Climate Adaptation, for every $1 of insurable loss, there is generally $3 to $4 of uninsurable loss realized.

To understand what the Canadian insurance industry may be trending towards, we can look to the United States. California has been facing a home insurance crisis for the past five years, without an end in sight. Wildfires are driving up claims, leading to huge rate hikes while insurance companies themselves withdraw.

Tokio Marine cut 12,556 policies with $11.3 million in premium this July, State Farm cut 72,000 policies, and others such as Allstate, The Hartford, Farmers Insurance, and USAA, have limited or halted new coverage. California’s property insurer of last resort, the California FAIR Plan, is facing potential losses of $311 billion. While Canada is not there yet, as unmanageable wildfire events become predictable, Canada becomes similarly uninsurable.

We acknowledge that Canadian insurers are providing vital support during this crisis. The IBC has made several resources available regarding the 2024 wildfire season and guidance for those affected by the Alberta wildfire. Some agencies are also on the ground at evacuation centers to help navigate the claims process. Insurers including Definity and Intact have also begun to offer free wildfire loss prevention and mitigation services to some residents in Alberta and British Columbia.

However, the significant investments in fossil fuels by insurers cannot be ignored. As the damage from wildfires continues to escalate, insurers must recognize their role in fueling the fire. For example, no “second responder” committed to safeguarding communities should be underwriting any fossil fuel expansion projects, yet no major Canadian insurer has yet committed to this.

As the Jasper fires demonstrate, we are past time to transition away from fossil fuels. Energy companies without a clear plan to transition, including those expanding oil and gas or failing to phase out coal within a few years, are not part of an insurable future. Insurers can rectify this by leaning into their role as second responder, and eliminating their role as a causal agent encouraging the fossil fuel industry.

Because voluntary action is unlikely to work by itself, regulators must step up. The Office of the Superintendent of Financial Institutions already regulates capital requirements for insurance companies and should use this tool to properly align incentives regarding fossil fuel investments. It should also require more specific and credible climate transition plans. Provincial regulators can improve public access to climate-risk data and address the practice of annual risk repricing. Encouraging insurers to adopt a long-term perspective can help stabilize rates and protect consumers.

Our world is on fire. It’s time to act.