Climate Action 100+ (CA100+) “is an investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change.” Each year it puts out an evaluation of some of the largest polluters in the world on their progress towards net zero.

The CA100+ is an impressive group of investors with major clout. It includes Blackrock, the world’s largest asset manager, along with heavy hitters like State Street, UBS Group, and JP Morgan. In Canada it includes RBC Global Asset Management, Manulife Investment Management, and TD Asset Management.

These are investors that can drive a lot of change in their investees – if they choose to.

Recently the CA100+ put out its company assessments for 2021, and the global picture wasn’t pretty. Generally, it found:

- An absence of medium-term emissions reductions targets aligned with 1.5°C

- Continued absence of Scope 3 emissions

- Alignment of capex strategies with net zero transition goals remains almost non-existent

- Companies are setting emissions reduction targets but don’t have the strategies to deliver them

- A failure to integrate climate risk into accounting and audit practice

These kinds of details matter, particularly to our media discourse that generally accepts corporate net zero statements at face value, without digging into whether they are credible.

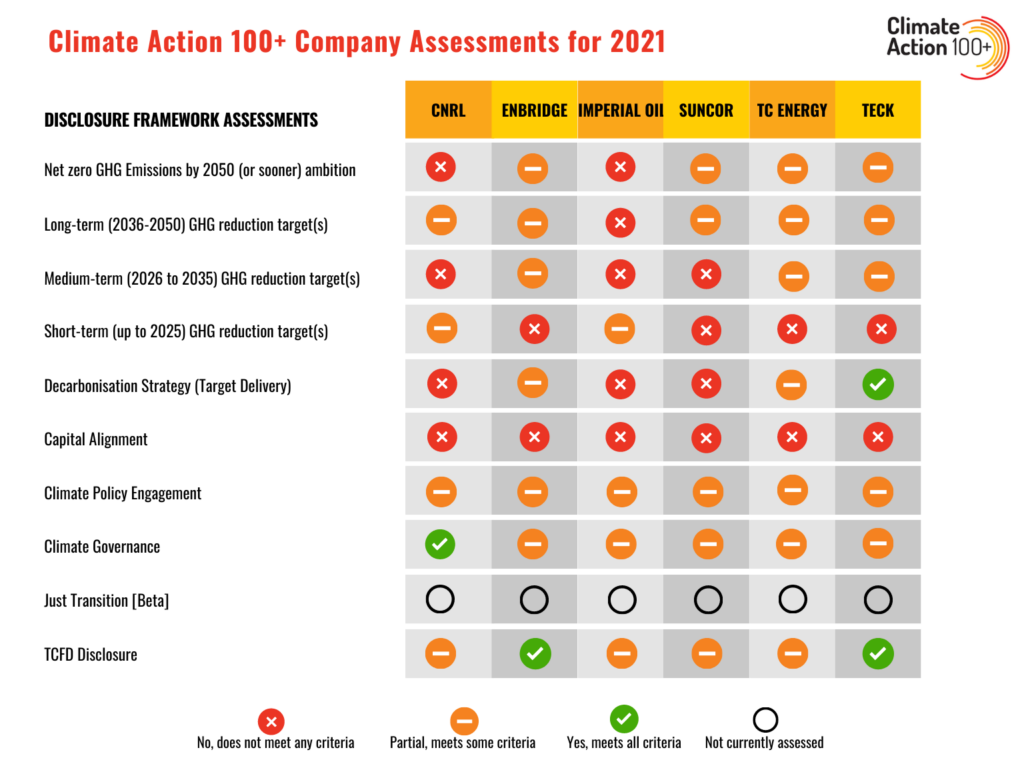

There are six Canadian companies on the CA100+ list, and they fared equally badly. Here is a table that summarizes their evaluation.

On the all-important “follow the money” assessment – capital alignment – we see red crosses across the board. Setting aside Teck (which also has oil sands assets), these results are a reflection of the fact that the Canadian energy industry is still to grapple with actual transition away from fossil fuels, preferring instead oil and gas expansion coupled with the risky Hail Mary pass called CCUS, which even if successful (unlikely) would not address downstream emissions necessary for net zero.

The question becomes: Now what? The major investors know that these companies aren’t measuring up, so what are they prepared to do about it? We hear vague platitudes about “engagement,” but we’ve been hearing this for years without any discernable progress. Meanwhile, the climate crisis is accelerating.

One thing that CA100+ members can do is to vote for relevant shareholder proposals like the one we filed at one of the companies evaluated – Enbridge. It asks for a “science based” net zero plan from the company that includes elements laid out in the chart above, instead of the vague version Enbridge has put out that doesn’t have absolute emissions reductions targets, ignores Scope 3 emissions, and doesn’t align capex. In fact, voting against the proposal would be akin to voting against the CA100+ assessment itself.

More generally though, we need CA100+ members to step up and hold these companies accountable. If engagement is a dead end – including shareholder votes – then divestment becomes the best option.