This season we filed this shareholder proposal at Sun Life. You can find our more detailed investor brief here.

We have asked Sun Life for a report on the current and future health impacts of its fossil fuel investments on its existing and potential clients. We see this as a first step to the company assessing the contradiction so that it can better address it. As we note in our investor brief, the Geneva Association and the UNEP call on the industry to report on this material financial risk, and provide guidance on how to do so.

Sun Life is one of Canada’s largest health and life insurers, and also a massive asset owner and manager, with about $1.4 trillion in AUM. That juxtaposition, however, is in tension and this is growing due to the climate crisis.

The tension is related to the health impacts of fossil fuels. Sun Life has tens of billions of dollars invested in fossil fuels and is Canada’s largest coal investor.

Burning fossil fuels, and particularly coal, results in a range of dangerous air pollutants that cause adverse health impacts, including hundreds of thousands of premature deaths each year. That outcome is the opposite of Sun Life’s purpose, which is “to help our clients achieve lifetime financial security and live healthier lives.”

The climate crisis – also caused by the burning of fossil fuels – will accelerate negative health outcomes. 619 people died in BC during the 2021 heat dome. Climate change is already a mental health issue for Canadian youth, with 40% saying that climate anxiety affects their daily functioning. A major Canadian government assessment on health and climate concluded that climate is already negatively affecting the health of Canadians and that health risks will increase with warming.

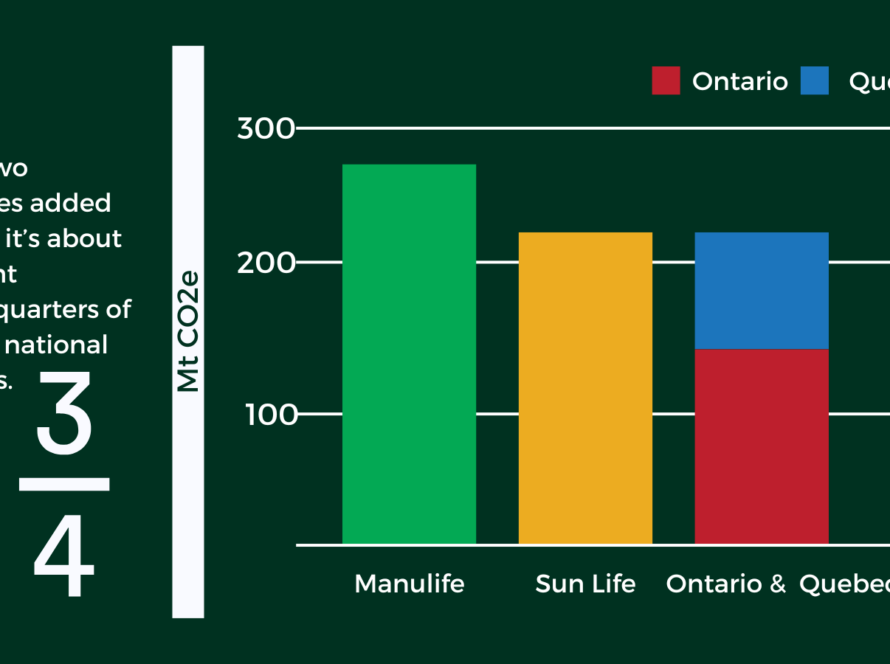

Sun Life has made a commitment to reach net zero in its financed emissions by 2050. The company has a significant challenge in this regard – we estimate Sun Life’s financed emissions as equivalent in size to the combined entire emissions of the provinces of Ontario and Quebec.

But we are yet to see adequate progress from Sun Life in developing policy to actually reach net zero, and in particular to tackle its unhealthy fossil fuel investments. The company is relatively decentralized and one smaller subsidiary – InfraRed – is tackling fossil fuels. But other larger subsidiaries aren’t, and neither is the company’s own General Account (the assets it owns).

The contradiction between Sun Life’s core health and life insurance business and its asset management poses a business risk to the company. Sun Life’s clients are already experiencing negative health outcomes from fossil fuel burning and this trend is set to accelerate. The company is also seeking to expand in Asia where people are more vulnerable to climate impacts.

The Toronto Star published an article on this resolution.